Streamline Compliance, Mitigate Risk, and Drive Success

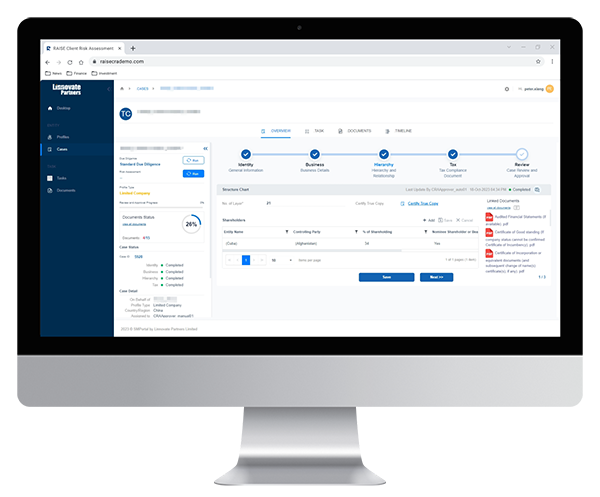

RAISE CRA is a next-generation compliance platform that streamlines and enhances essential processes such as due diligence, AML, and KYC procedures. By leveraging automation technology, industry expertise, and a workflow-driven approach, RAISE CRA effectively mitigates financial and reputational risks while ensuring regulatory compliance.

| Automated Risk Assessments Stay ahead of potential risks with our automated risk assessment feature. RAISE CRA continuously monitors client information and external factors, providing real-time insights that empower informed decision-making. |

| Workflow Driven Experience a seamless, workflow-driven approach to compliance. RAISE CRA integrates with your existing processes, ensuring that all compliance tasks are efficiently managed and tracked. |

| Investor Classification RAISE CRA enables you to segment investors based on risk profiles and behaviors, facilitating tailored risk management strategies that comply with regulatory standards. |

| AI-Driven Data Entry Process RAISE CRA automatically extracts data from uploaded documents, populating the necessary fields in the CRA. This significantly reduces manual input and minimizes errors, allowing KYC analysts to focus on more strategic tasks. |

| Open Sanction Integration RAISE CRA integrates with the third-party due diligence data platform, Open Sanction. This feature allows KYC analysts to access and monitor due diligence data for target entities directly within the CRA, enhancing the depth of your compliance checks. |

| FATCA & CRS Information in Tax Profiles RAISE CRA includes FATCA and CRS information directly in client tax profiles, providing you with all necessary data for accurate reporting and adherence to global tax standards. This feature simplifies the complexities of international compliance. |

Why Choose RAISE CRA?

Efficiency

Automates tasks to reduce processing times and errors, enabling your team to focus on strategic activities.

Accuracy

Provid es reliable data analysis through automation, minimizing human error for effective compliance management.

Real-Time Insights

Continuously monitors data to provide actionable insights, helping your team make proactive decisions and mitigate risks.

Compliance

Adapts to regulatory requirements like FATCA, CRS, and KYC, ensuring your firm navigates compliance challenges with confidence.

Scalability

Customizable to grow with your organization, accommodating the specific needs of both small firms and large enterprises.

User-Friendly Interface

Intuitive design simplifies navigation, allowing compliance professionals to easily adopt and maximize the platform’s benefits.

RAISE CRA is not just a compliance tool; it’s a comprehensive solution that empowers organizations to navigate the complexities of compliance with confidence. By combining automation, integrated workflows, real-time insights, and a user-friendly experience, RAISE CRA truly represents the next generation of compliance platforms.

RAISE by Linnovate Partners powers the leading private equity and venture capital firms, fund of funds, and real estate funds with over $130bn+ AUM on our platform globally.